Share

For centuries, gold has been a symbol of wealth and stability, deeply entrenched in human culture and economic systems. In the modern world, its significance extends beyond mere ornamentation and currency backing. Amid the instability of financial markets, gold continues to shine as a beacon of security. Its value is not just monetary, we now see sectors such as chip manufacturing and medicine making extensive use of the precious metals. Furthermore, the evolving practice of sustainable mining reflects a conscientious approach to harnessing this precious resource.

Instability of the Global Financial System

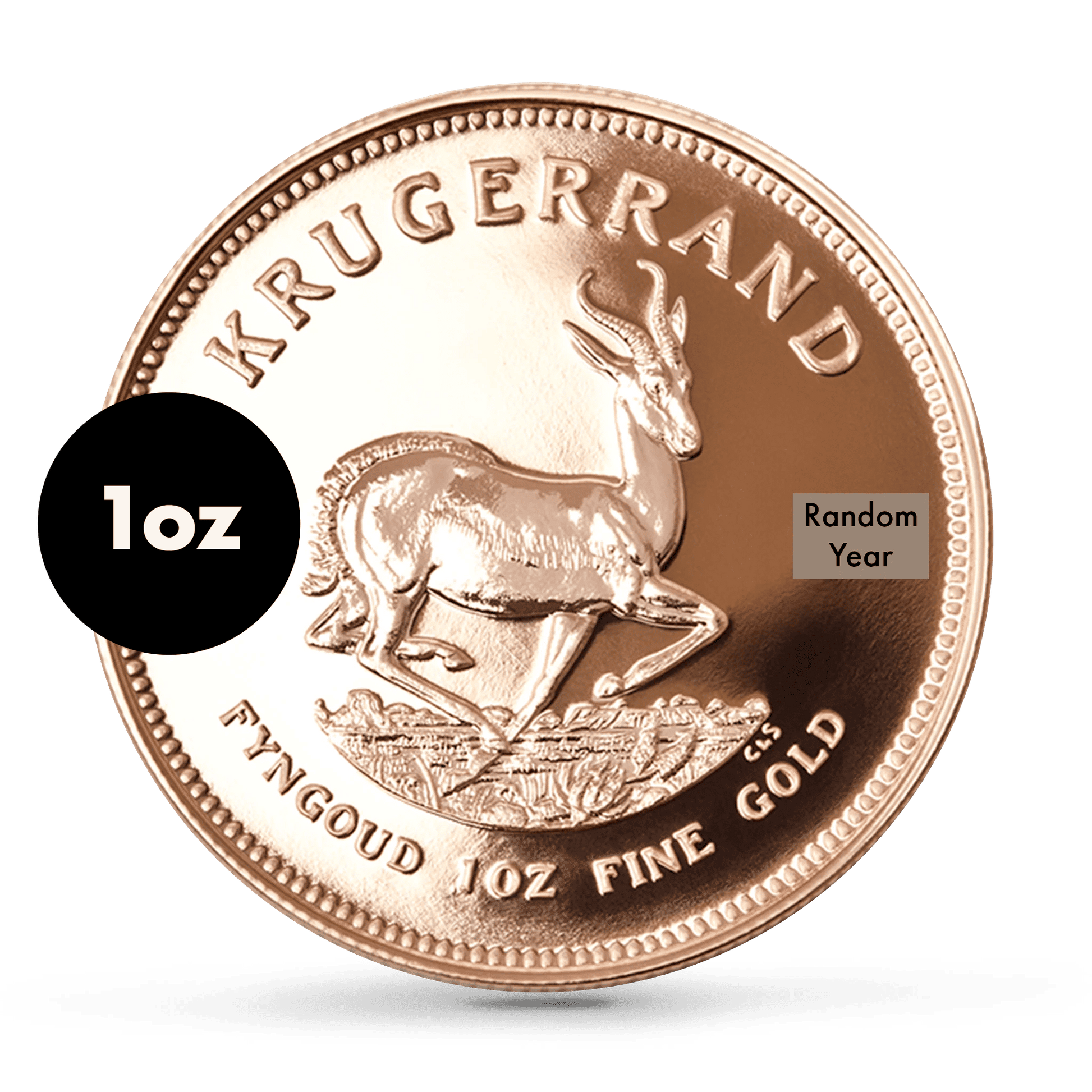

In the realm of global finance, gold has historically been a symbol of stability and security. Its role becomes particularly crucial during times of economic turbulence. Unlike fiat currencies, which are subject to inflation and governmental policies, gold's intrinsic value offers a safe haven for the people smart enough to hold some. This characteristic has become increasingly relevant in the face of recent global financial crises, geopolitical tensions, and market volatility.

Historical trends reveal that during economic downturns, investors often turn to gold as a hedge against inflation and currency devaluation. For instance, the financial crisis of 2008 saw a significant surge in gold prices, reflecting its status as a 'crisis commodity'. Looking forward, many financial analysts predict a continued reliance on gold in investment portfolios, especially as uncertainties in the global market persist. The diversification benefits of gold cannot be overstated. Its proven negative correlation with stocks and bonds makes it a strategic asset in managing risk and protecting wealth.

The digital age has also seen innovative forms of gold-based investment, such as gold-backed cryptocurrencies and gold ETFs, making gold more accessible to a broader range of investors. This blend of traditional value and modern technology positions gold uniquely in the contemporary financial landscape, ensuring its relevance in the face of a rapidly changing global economy.

Physical to Digital: Commodities trading has been a staple in many investor's portfolios for a long time, but with the rise of private investors using digital platforms it has really exploded in the last decade.

The Rise of Digital Gold

In the contemporary financial landscape, the concept of gold has transcended its physical boundaries, giving rise to digital gold and Gold Exchange-Traded Funds (ETFs). This digital revolution in gold investment democratises access to this precious metal, allowing a broader range of investors to partake in its age-old allure. Digital gold, essentially gold in electronic form, offers investors the opportunity to buy, hold, and sell gold without the logistical challenges of physical storage.

It represents a significant shift in how gold is traded, combining the security and stability of traditional gold investment with the efficiency and accessibility of digital platforms. The appeal of gold ETFs lies in their liquidity and ease of trading, much like stocks. All this while still providing a hedge against market volatility and inflation, a widely known and utilised aspect of gold. The rise of digital gold and gold ETFs is reflective of a broader trend towards digitisation in the investment world, marrying the timeless value of gold with modern financial technologies.

Gold in Medical and Technological Applications

Gold's unique physical and chemical properties make it invaluable in the realms of technology and medicine. Its excellent conductivity, resistance to corrosion, and biocompatibility underpin its diverse applications.

In technology, gold is essential in the manufacturing of high-end electronics and components. Its conductivity ensures reliable performance in devices ranging from smartphones to satellite systems. The demand for gold in electronics has steadily increased, especially with the rise of sophisticated gadgets and technologies. This growing demand in the tech industry could influence the market value of gold, potentially driving up its price as tech companies vie for this precious and limited resource.

In the medical field, gold's biocompatibility and non-toxicity have led to revolutionary uses. It's a key component in diagnostic equipment and life-saving medical devices. Gold nanoparticles are at the forefront of medical research, used in targeted drug delivery systems and cancer treatment methods. As research and development in these areas expand, the medical sector's demand for gold is likely to escalate. This increased medical usage could further impact the gold market, contributing to a rise in its price as it becomes more integral to healthcare innovations.

Sustainable Mining of Gold

Traditional mining practices have led to deforestation, water pollution, and greenhouse gas emissions. However, the shift towards sustainable mining practices is reshaping the industry. These include reducing the ecological footprint, using eco-friendly mining technologies, and ensuring fair labour practices. Many mints and resellers around the world now only source their precious metals from suppliers that have been fair mined approved. An initiative to ensure that progressive labour practices are observed and the mines are community owned or a significant amount of their profits channelled back into the local community.

Advancements in sustainable mining are essential for the long-term viability of gold extraction. As the industry moves towards more environmentally conscious methods, the costs associated with sustainable mining could influence the overall market price of gold. Implementing greener technologies and adhering to environmental regulations often require additional investments, potentially increasing production costs. This shift could make gold more valuable, not just in monetary terms but as a symbol of environmental responsibility.

The bottom line

The increasing demand from technology and medical sectors, coupled with the costs of sustainable mining, suggests a potential increase in gold prices. However, market dynamics are influenced by a multitude of factors, including global economic conditions, investment trends, and technological breakthroughs. As such, while the demand and ethical sourcing of gold point towards an upward trend in prices, it's important to consider the broader economic and market contexts in forecasting the future value of gold. The legal fraternity loves to use precedent as a basis for their arguments, and in gold the precedent is hard to overlook. Gold has consistently been on a steady rise for most of the millennium.

The journey of gold, from a symbol of ancient wealth to a cornerstone in modern finance, technology, medicine, underscores its enduring value and versatility. As we navigate through the complexities of global financial instability, gold stands as a steadfast asset, its allure only heightened in times of economic uncertainty.