Share

Gold’s having a moment in 2025, and it’s not just because it sparkles.

This metal’s been breaking records, turning heads, and making wallets swoon, with prices soaring past $3,339 per ounce in April. Think of gold as the bad boy of investments—thriving on global chaos, winking at uncertainty, and stealing the show while Bitcoin pouts in the corner. So, why’s gold the hottest ticket in town? Let’s dive into its 2025 glow-up and how you can flirt with this shiny seducer without getting burned.

A Golden Rampage in 2025

Gold’s been on a wild ride, surging 20% in Q1 2025 from $2,658 to a dazzling $3,165 by early April. What’s got it so cocky? Global drama, that’s what. Trump’s tariff tantrums and trade war jitters have investors clinging to gold like it’s the last chopper out of a crisis zone. A softer dollar and central banks—like China and Uzbekistan—stockpiling 244 tons in Q1 have only juiced the rally. When the world’s a mess, gold struts in, pours itself a drink, and owns the chaos. Hitting $3,074.43 in March amid geopolitical spats, it’s clear: uncertainty is gold’s love language.

Millennials Are All Over It

Gold’s not just for your grandpa’s safe anymore—it’s got millennial clout. Social media’s buzzing with influencers calling gold the “new flex,” and the kids are listening. Gold ETFs raked in $9.4 billion in February 2025, showing even Wall Street’s smitten. Why the hype? Gold’s the anti-crypto, the reliable heartthrob that doesn’t crash during a tweet-storm. While Bitcoin’s out there rollercoastering, gold’s been slaying for 5,000 years. It’s like avocado toast but shinier, with zero risk of spoiling. Millennials are swiping right, and gold’s loving the attention.

How to Date Gold Right

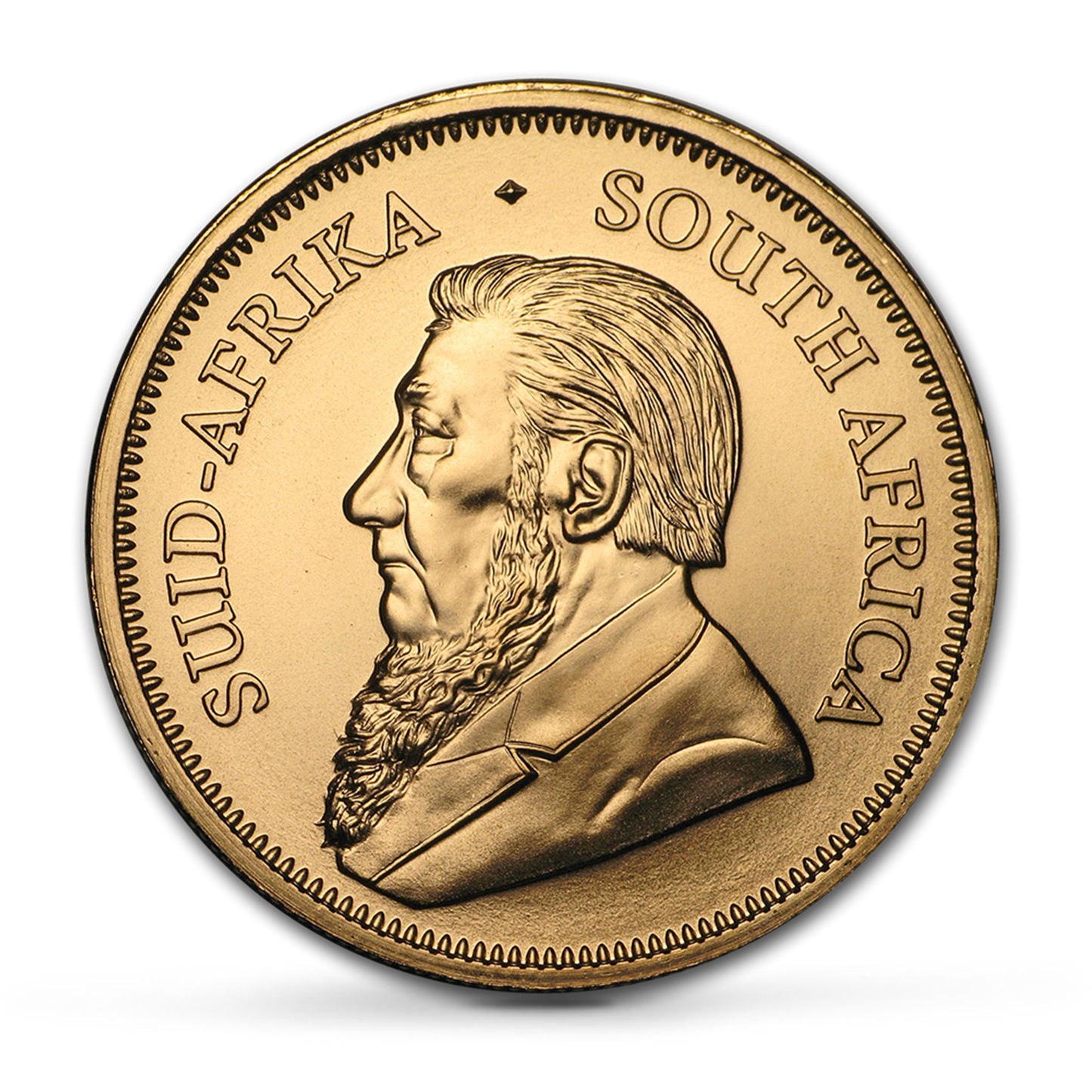

Ready to cosy up to gold without diving in headfirst? With physical gold, you can start small and build your stash over time, like a savvy pirate with a plan. Begin with gold coins or small bars—think 1-gram or 1-ounce pieces—that won’t break the bank but still carry that shiny swagger. Want to grow your treasure? Add a coin or bar whenever you’re ready, steadily stacking your wealth as gold’s value climbs. China’s new move to let insurance firms invest in gold hints at a demand surge, so starting now could be your golden ticket. No need to hide a massive bar under your bed—small, smart purchases let you flirt with gold’s charm at your own pace.

Gold’s the 2025 MVP

In 2025, gold’s not just a metal—it’s a whole mood. It’s your portfolio’s wingman when the world’s throwing punches. Team gold or team crypto, this seducer’s worth a wink.

Ready to get gilded?