Share

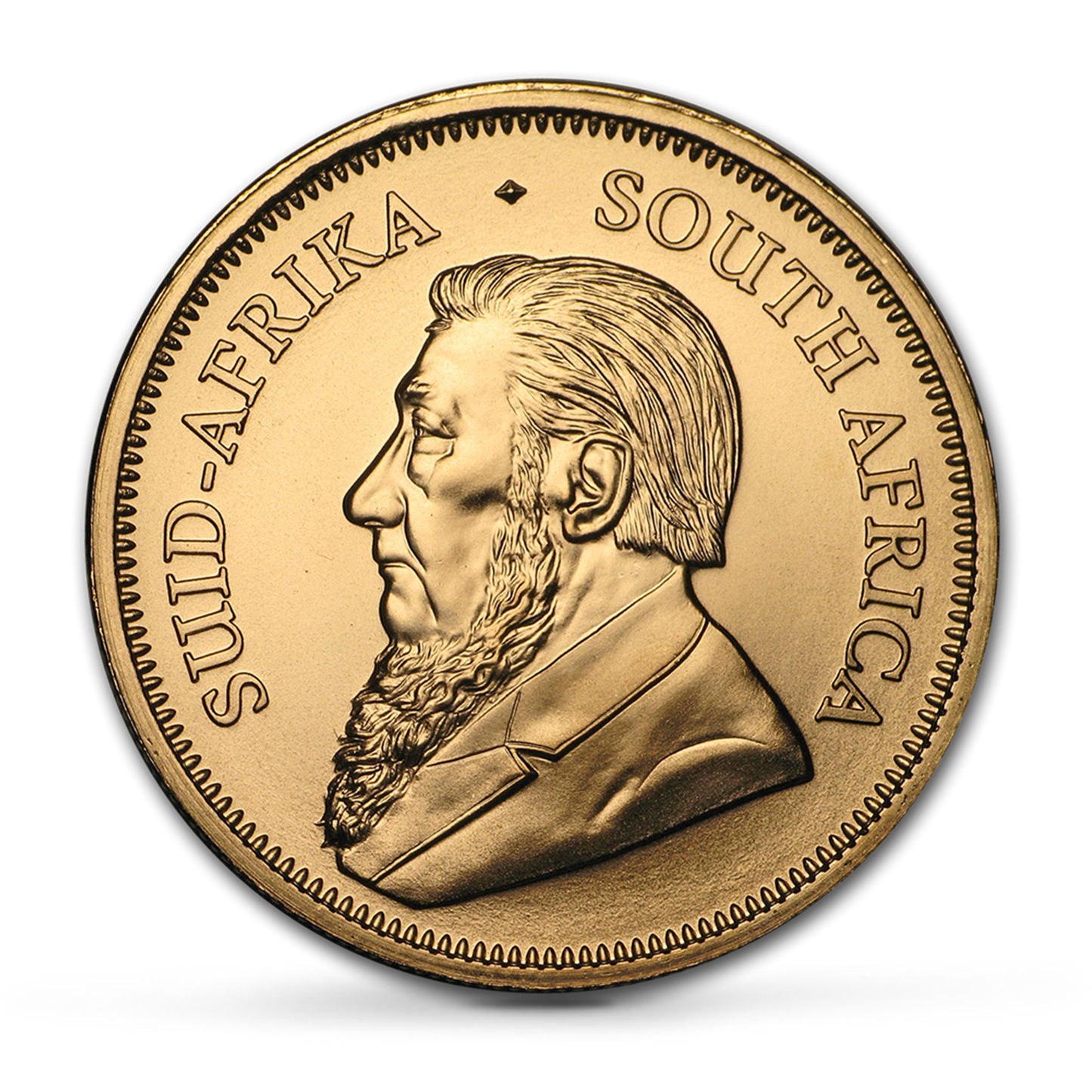

Considering buying gold?

It’s gaining significant attention in 2025, with prices surging past $3,000 an ounce this year. Here are five clear reasons why now might be the right time to buy, presented without hype—just the facts.

1 The Rand’s Under Pressure

Inflation has been a persistent challenge, sitting at around 5-6% recently and impacting everyday costs. Gold offers a reliable counterbalance as the rand weakens. With prices climbing beyond $3,000 in 2025—up from $2,639 at the start of the year—it’s proving its worth as a safeguard against currency erosion.

2 Global Uncertainty Persists

From ongoing conflicts to trade disputes, the world remains unpredictable. Gold stands apart, unaffected by local politics or global shifts. The South African Reserve Bank holds over 125 tons, while nations like China added more than 1,000 tons in 2023. With prices now exceeding $3,000, it’s a strategic move for stability.

3 The JSE Faces Risks

The stock market has shown gains, but structural challenges and energy insecurity continue to pose risks, keeping it vulnerable. Gold provides a buffer—during the 2020 global downturn, it rose 8% as stocks fell. At over $3,000 an ounce in 2025, balancing exposure if the JSE falters is a practical option.

4 Digital Systems Aren’t Foolproof

Cybercrime continues to escalate, with South African banks losing billions annually to breaches. Physical gold, now valued above $3,000, offers security no digital asset can match. Stored in a safe or vault, it’s immune to hacks or disruptions—pure ownership, no intermediaries.

5 Demand Is Driving Prices Up

Global appetite for gold is strong, with ETF holdings at 3,624 tons and South Africa contributing 87 tons to production in 2023. Prices have soared past $3,000 this year, and analysts like Goldman Sachs project $3,100 by December. With economic headwinds looming, now could be an opportune moment to diversify.

When purchasing gold, it’s critical to choose credible dealers who comply with South Africa’s regulatory framework. Opt for those adhering to Know Your Customer (KYC) requirements, the Financial Intelligence Centre Act (FICA), and Anti-Money Laundering (AML) measures.

Every South African should have the ability to buy and sell physical gold, especially amid rising global uncertainty.

- Rael Demby, CEO of The South African Gold Coin Exchange & The Scoin Shop, a trusted name that celebrated 25 years of service in 2024.

Do your homework—understand the product, and seek advice if needed—to ensure your investment is legitimate, secure, and aligned with national standards, protecting you and the integrity of the market.