Share

Tariff policies have shaken investor confidence in traditional safe havens like the U.S. dollar

In a dramatic response to mounting global uncertainty, gold prices have soared 40% since January, smashing previous records to trade above $3,600 per troy ounce. This surge marks the highest level ever recorded and underscores the metal’s enduring appeal in turbulent times.

A powerful mix of factors is fueling gold’s meteoric rise. Robust central bank purchases—especially among emerging markets—have provided a solid foundation, with more than 1,000 tonnes acquired annually since 2022, according to industry data. At the same time, escalating geopolitical tensions and widespread concerns over the impact of U.S. tariff policies have shaken investor confidence in traditional safe havens like the U.S. dollar.

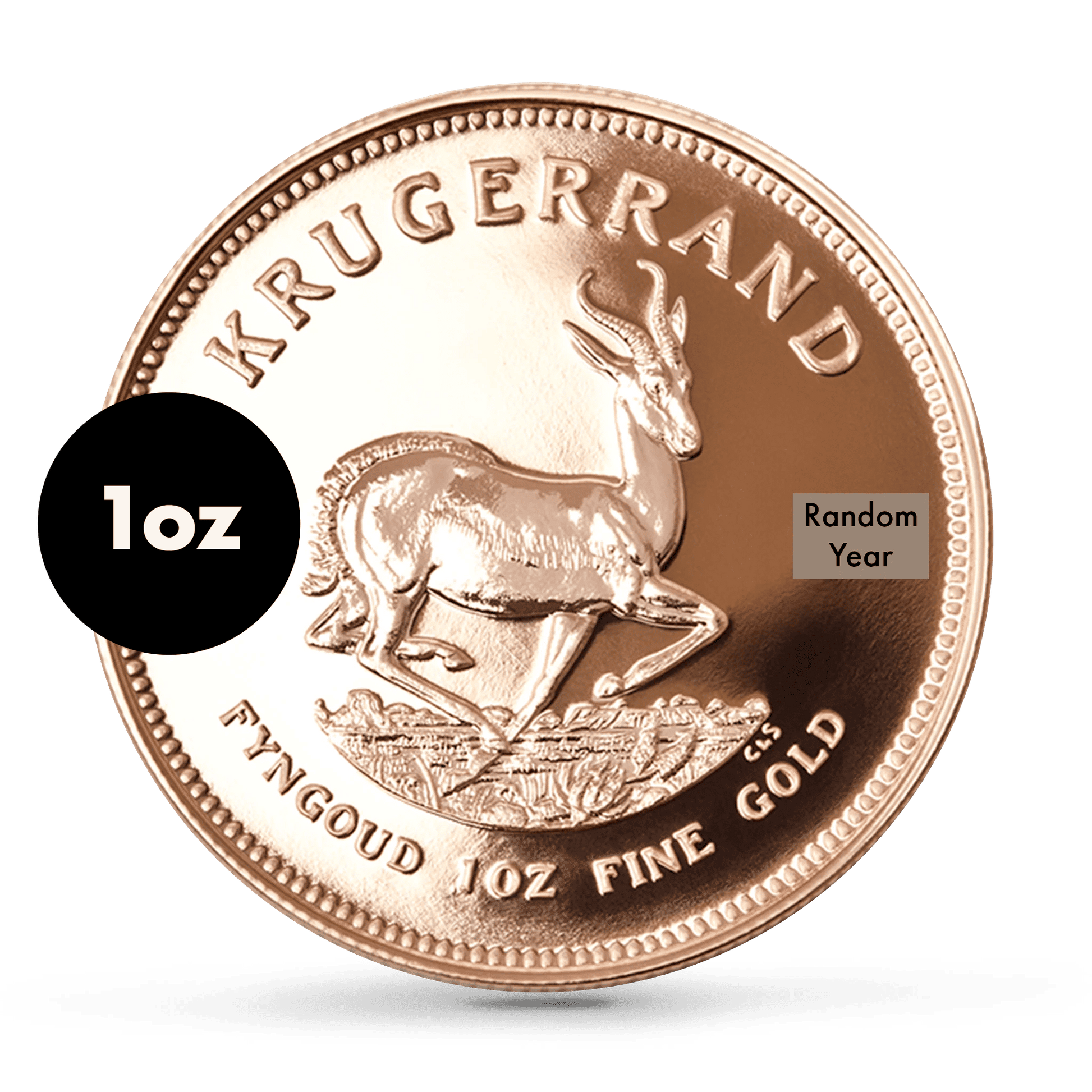

“The U.S. tariff policies under President Trump have created a lot of economic uncertainty, leading investors to move away from traditional safe-haven assets like the U.S. dollar,” said Rael Demby, CEO of The South African Gold Coin Exchange & The Scoin Shop. “We’re seeing strong demand for gold bullion and collectable coins like Krugerrands, with our sales up significantly this year as people turn to gold to protect against inflation and currency fluctuations.”

Financial institutions are taking notice. Goldman Sachs projects that gold could reach $3,700 by year-end, with the potential to climb as high as $4,500 if trade tensions escalate or challenges to U.S. Federal Reserve independence intensify. With interest rate cuts expected from the Federal Reserve in 2025, gold’s status as a non-yielding but stable asset is only expected to strengthen.

“ Gold remains a trusted choice for investors navigating these uncertain times,” Demby added. “Its value as a safe-haven asset continues to shine through.”

As global markets brace for continued volatility, all eyes are on gold’s next move—solidifying its status as the ultimate shelter in times of economic storm.

Listen to the 702 interview with Rael here.