Share

In recent weeks, the United Kingdom has witnessed an unprecedented movement of gold reserves,

with traders transferring significant quantities of bullion from London to New York. This surge, driven by concerns over potential tariffs on precious metals, has led to a notable depletion of gold stocks in London and raised questions about the reliability of paper gold instruments.

The Transatlantic Gold Migration

The catalyst for this mass relocation of gold is the looming threat of tariffs on raw materials, including gold, by the U.S. administration. In anticipation, traders have expedited shipments of gold to New York to preempt potential trade barriers. This proactive strategy has resulted in approximately 400 metric tonnes of gold being moved to New York's COMEX commodity exchange, elevating its holdings to 926 tonnes—the highest since August 2022. Consequently, the Bank of England's vaults have experienced significant outflows, leading to delays of up to eight weeks for those seeking to retrieve their gold investments.

Implications for Paper Gold Instruments

This situation underscores the inherent vulnerabilities associated with paper gold instruments, such as exchange-traded funds (ETFs) and other derivatives that represent gold ownership on paper but are not backed by physical gold. During periods of market dislocation, the prices of paper gold can decouple from those of physical gold, potentially leaving investors with contracts that don't guarantee delivery of the actual metal. This decoupling poses a risk for investors who might assume they are buying gold exposure but are instead acquiring a claim on gold that isn't matched by reality.

"The current gold exodus from London is a wake-up call for investors relying on paper gold. In times of uncertainty, only physical gold holds real value—everything else is just a promise. At The Scoin Shop, we ensure our clients have access to tangible wealth that stands the test of time."

— Rael Demby, CEO, The Scoin Shop

The Case for Physical Gold Ownership

Given these developments, the importance of holding physical gold becomes evident. Physical gold ownership provides tangible security, free from the counterparty risks associated with paper instruments. In times of economic uncertainty or geopolitical tensions, possessing physical gold ensures direct control over one's assets, safeguarding against market volatility and institutional defaults.

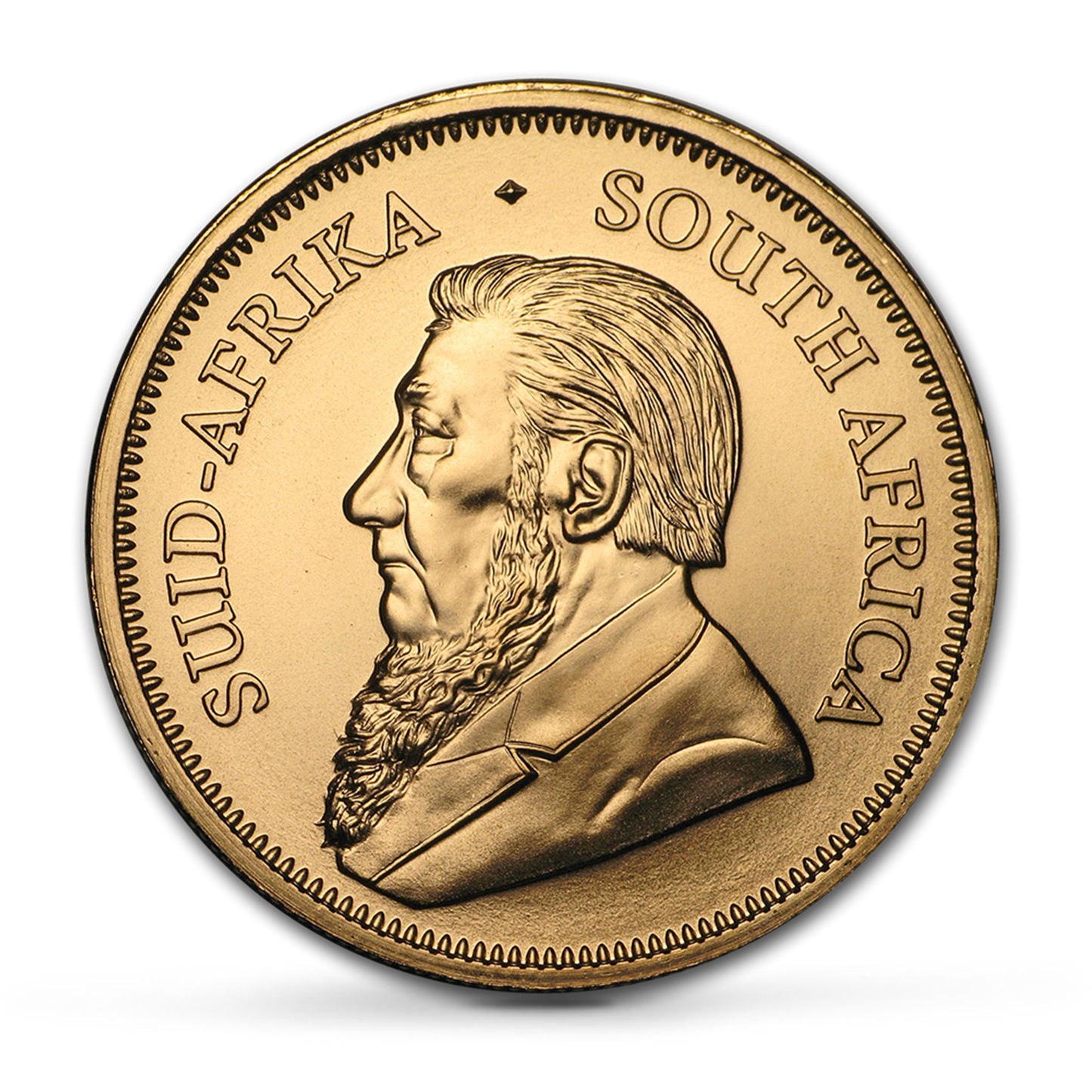

The Scoin Shop: Your Trusted Source for Physical Gold and Silver

For those considering the ownership of physical precious metals, The Scoin Shop offers a diverse selection of gold and silver coins to meet your investment needs. With a reputation built on trust and quality, The Scoin Shop ensures that each purchase is backed by authenticity and value. Whether you're a seasoned investor or new to precious metals, our expert team is ready to assist you in making informed decisions.

The current gold movements highlight the necessity of understanding the distinctions between paper and physical gold investments. By choosing to own physical gold, you not only secure your wealth but also gain peace of mind in an unpredictable financial landscape. Explore our extensive range of products online and in-store and take a proactive step towards financial security today.