Share

Many aspiring collectors and investors are discovering a silver lining: silver.

As gold prices surge to record highs above $4,000 per ounce, driven by safe-haven demand and expectations of further U.S. Federal Reserve rate cuts, many aspiring collectors and investors are discovering a silver lining: silver. Trading above $50 per ounce, reflecting a recent surge to new all-time highs, the white metal provides an accessible gateway into the world of precious metals, combining affordability, industrial relevance, and untapped appreciation potential.

We are noting a 25% uptick in silver coin inquiries from new collectors in the first half of 2025 alone, as enthusiasts who missed the early gold boom seek alternatives that don't require a fortune to start.

"Gold's meteoric rise has priced out many beginners, but silver is the perfect on-ramp,"

says Rael Demby.

“At current market levels, you can build a diverse silver collection at a fraction of the cost of gold, making it an accessible entry point for South African collectors. Silver's volatility often translates into significant percentage gains when the precious metals market rebounds.”

This shift aligns with broader 2025 trends in precious metals collecting. While gold has dominated headlines with its 58% year-to-date climb, silver has quietly followed suit, posting an 81% increase and reaching 13-year highs earlier this year—before surging to all-time records in October. Experts attribute silver's appeal to its dual nature as both a store of value and an industrial powerhouse. Unlike gold, which is primarily hoarded by central banks—with record purchases of 244 tonnes in Q1 2025—silver powers everything from solar panels to electric vehicles, fuelling demand amid the global green energy transition.

"Silver acts like a leveraged bet on gold," explains Demby.

"It tends to lag in the early stages of a bull market but outperforms in the later innings, often delivering double the percentage returns."

Indeed, silver has already outpaced gold in 2025, with a 70% year-to-date gain compared to gold's 56%. It has climbed to $53.40 per ounce amid a projected 3% surge in industrial demand year-over-year, with forecasts pointing to $65 or higher by year-end. For collectors, this translates to exciting opportunities in vintage coins, bars, and rounds that blend numismatic value with metal content.

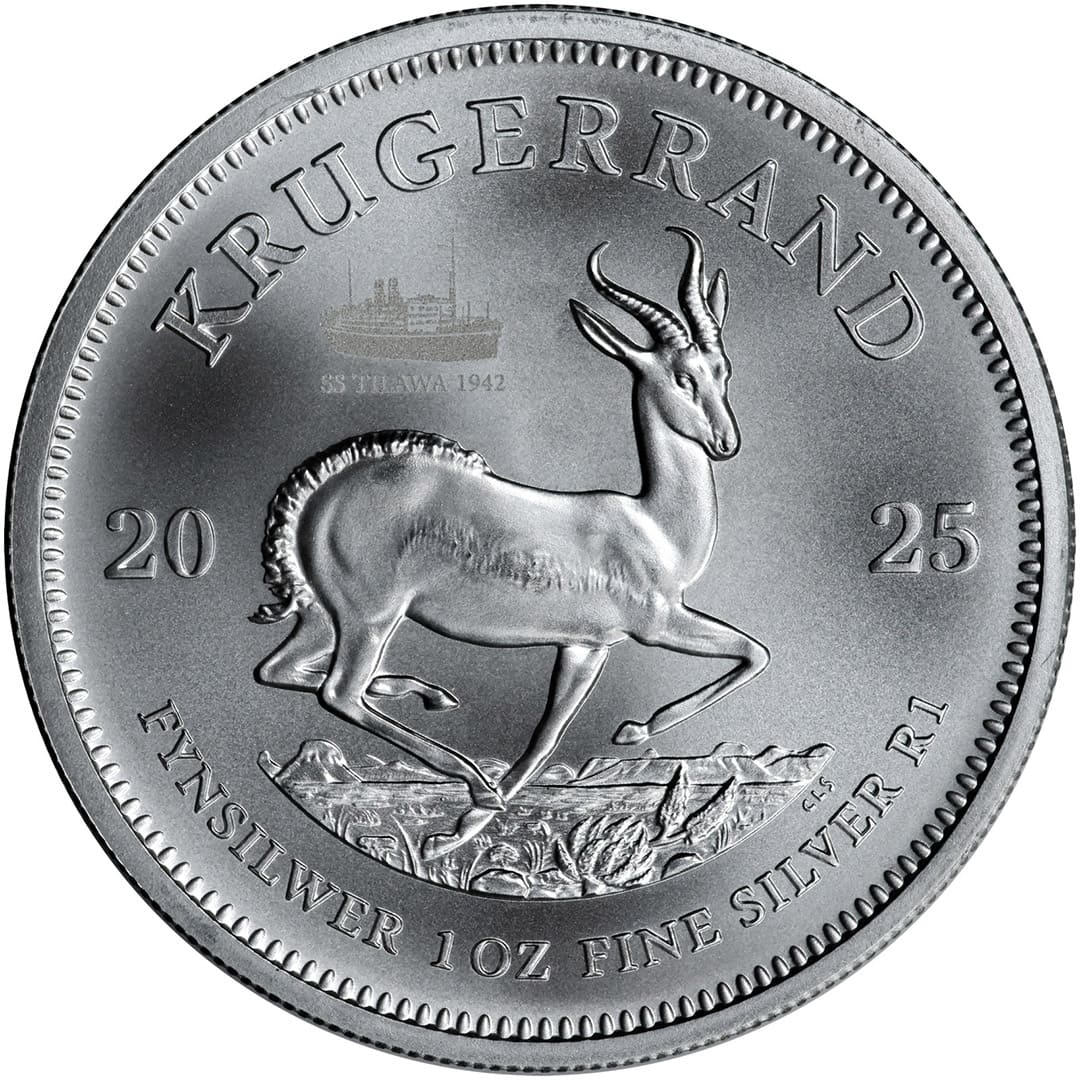

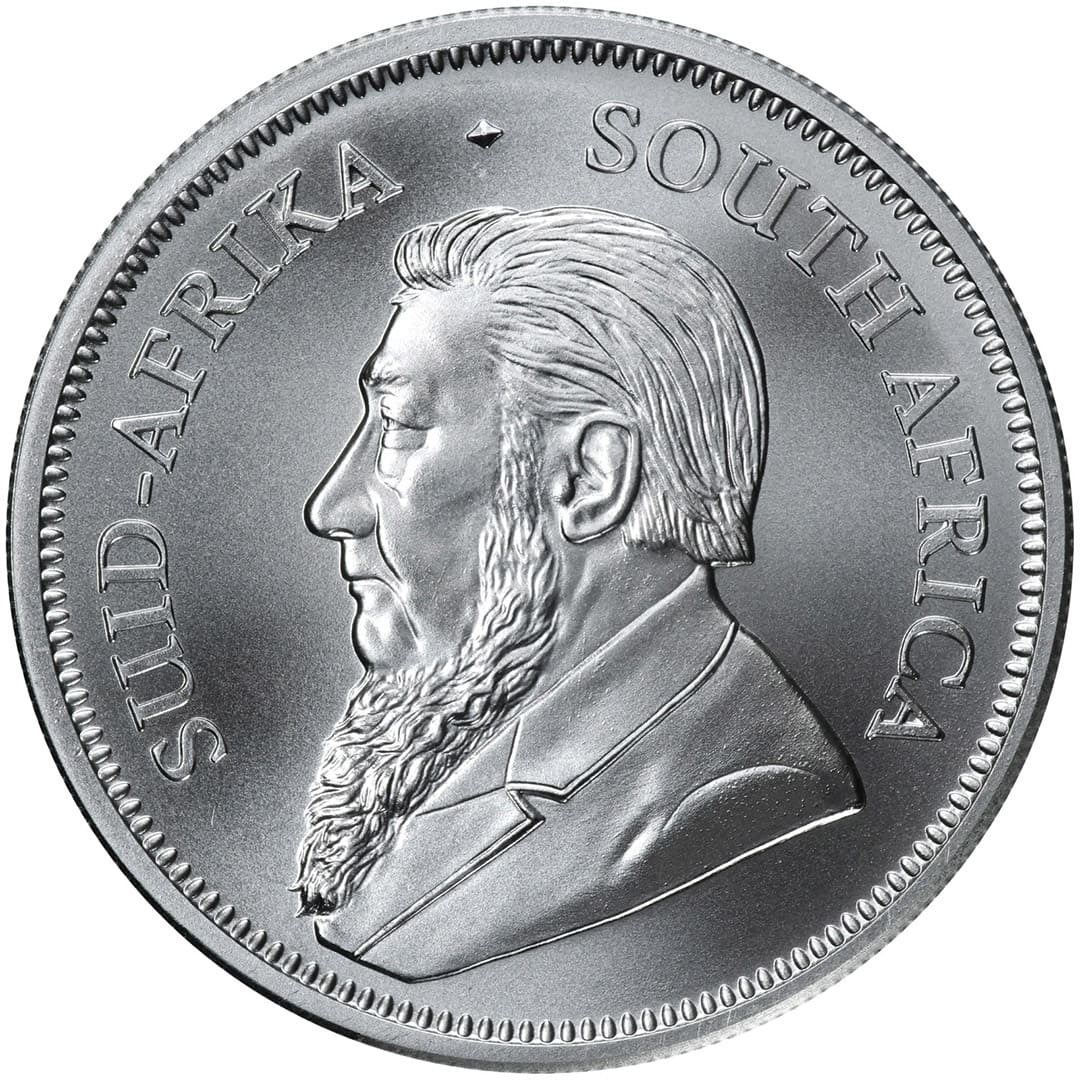

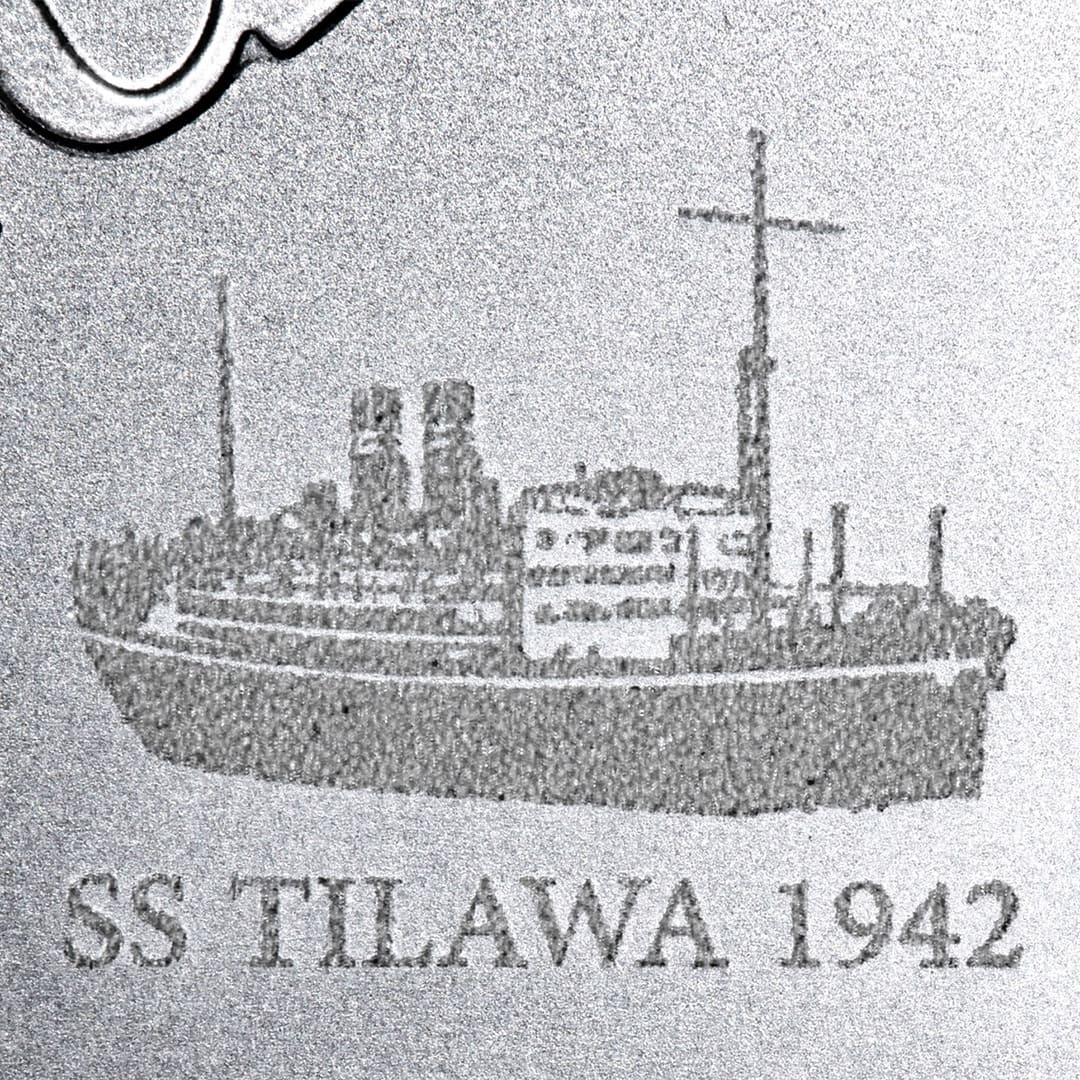

Beyond economics, silver's allure lies in its rich history and variety. From the iconic Silver Krugerrand, symbolising South Africa’s rich numismatic heritage, to modern, Nobel Silver medallions celebrating the legacy of the Nobel Peace Prize, collectors can curate themes around exploration, innovation, or even pop culture. "Silver coins tell stories", Demby adds.

"They're more attainable for storytelling collections, like the Masterpieces of Art series by Monnaie de Paris, honouring pivotal moments in European cultural heritage. This collection is fantastic for fine art lovers, silver investors, and elite collectors.”

Market trends highlight silver’s growing appeal. Industry experts note that silver and platinum are standout choices for portfolio diversification in 2025, thanks to their industrial applications compared to gold’s primarily monetary role. Physical silver sales have surged 40% among millennials entering the hobby. "We're seeing a generational shift," says Demby.

"Younger collectors value silver’s eco-friendly role in renewable technologies and its affordability, allowing them to build collections incrementally through Rand-cost averaging without financial strain."

For those dipping their toes, experts recommend starting with certified coins from reputable global mints like The Royal Canadian Mint to ensure authenticity and liquidity. "Avoid the hype; focus on quality and condition," advises Demby. For instance, the 2025 Canada Goose Silver Bullion Coin is a striking 2 oz. Investment-grade silver piece, capturing the elegance and endurance of one of Canada’s most recognised wildlife symbols. Crafted from 99.99% pure silver, this coin combines natural beauty with advanced security features, making it a secure and stunning addition to any collection or investment portfolio—sold in bundles of 25 units or more. Similarly, the Coronation of King Charles III, 5 oz. The 2023 Silver Coin from the British Royal Mint offers a historic single-unit option. Featuring the world’s first official crowned coinage portrait of His Majesty King Charles III, this limited-edition coin commemorates the historic coronation at Westminster Abbey on May 6, 2023. This beautifully crafted piece is a once-in-a-lifetime opportunity to own a tangible piece of royal history.

As geopolitical tensions and inflation persist—key drivers behind gold's rally—silver stands poised for its moment in the sun. Precious metal commentators predict continued tandem movement between the metals, but with silver's greater fluctuations offering "alpha" for risk-tolerant collectors.

“Whether building wealth or passion projects, silver proves that missing the gold rush isn't a loss—it's an invitation to a brighter, more inclusive one,”

- concludes Demby