Share

Gold has long been a safe haven in times of economic uncertainty.

But what happens when politics interferes with the gold market?

Former U.S. President Donald Trump has once again set his sights on South Africa, issuing a new executive order that could have serious implications for trade between the two nations. While the details of the order are still unfolding, it has raised concerns about potential tariffs or even economic sanctions. And for those who remember history, one question looms large: Could Krugerrands be banned again?

A Look Back: The U.S. Ban on Krugerrands

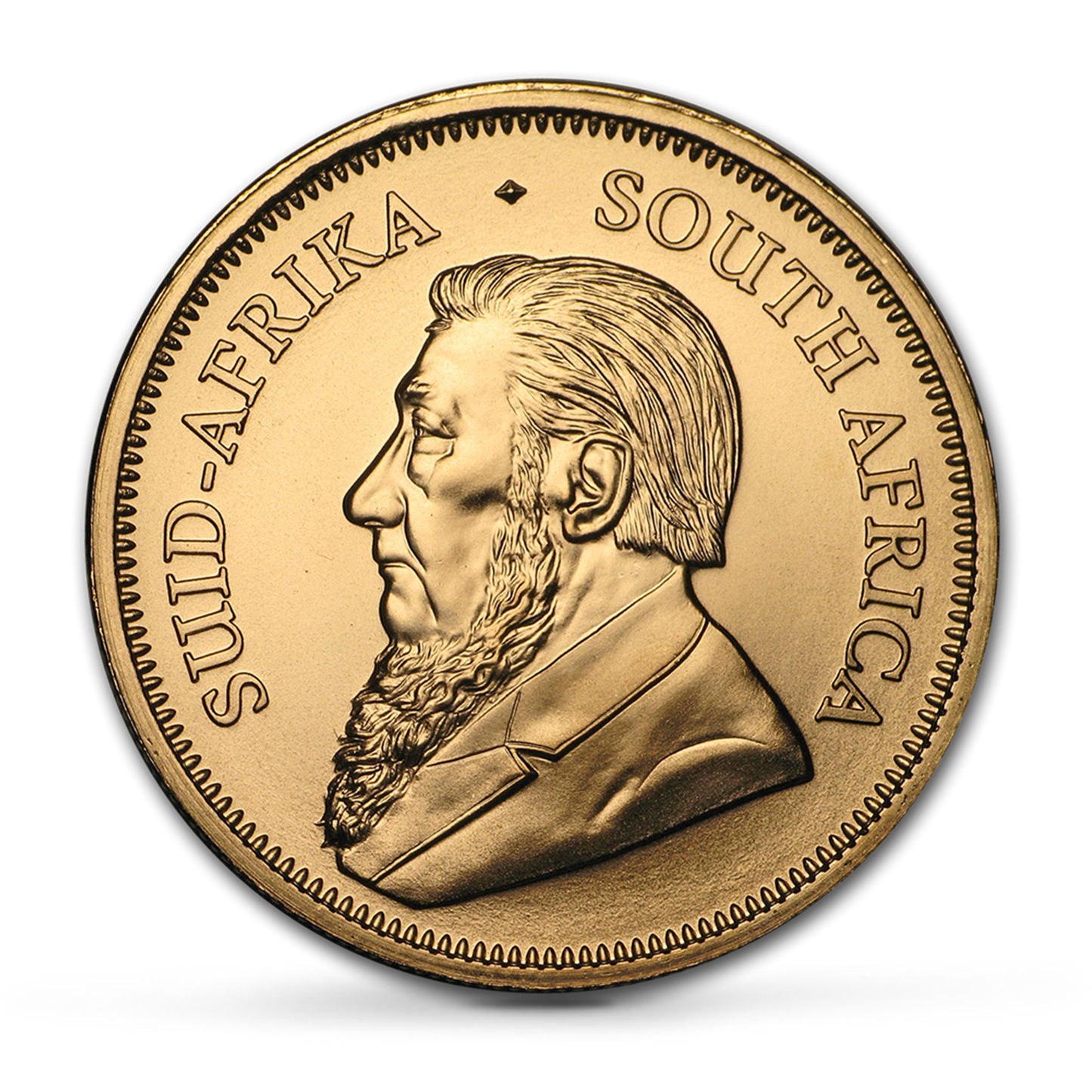

The Krugerrand, South Africa’s most famous gold coin, has had a controversial past when it comes to international politics.

First introduced in 1967 by the South African Mint, the Krugerrand was designed to make gold ownership accessible to the public. It quickly became one of the most popular gold bullion coins in the world due to its high gold content, durability, and liquidity. By the early 1980s, it accounted for a staggering 90% of the global gold coin market.

However, as South Africa’s apartheid regime faced increasing international backlash, Western nations imposed economic sanctions to pressure the government to dismantle the system. In 1985, the United States, under President Ronald Reagan, officially banned the import of Krugerrands as part of its sanctions against South Africa. This move was mirrored by the United Kingdom and several other nations.

The impact was immediate—Krugerrand sales plummeted, and South Africa’s gold industry faced major disruptions. The ban remained in place until 1991, after apartheid officially ended and South Africa began its transition to democracy under Nelson Mandela.

Could History Repeat Itself?

Now, with Trump’s new executive order targeting South Africa, there’s growing speculation that trade restrictions could once again impact the gold market. South Africa remains one of the world’s top gold producers, and Krugerrands continue to be among the most widely traded gold coins.

If the U.S. were to impose tariffs or sanctions affecting South African gold, it could impact global markets. Investors might see a surge in demand for Krugerrands due to uncertainty, potentially driving up premiums on the coin. Conversely, restrictions could make it harder for international buyers to acquire them, reducing their availability outside of South Africa.

The Geopolitical Ripple Effect

Economic sanctions and trade restrictions have long been used as tools of foreign policy. We’ve seen this playbook before with countries like Russia, Iran, and Venezuela, where gold has played a key role in bypassing sanctions.

Gold, unlike fiat currencies, is a physical asset that holds intrinsic value regardless of government policies. This has made it an attractive option for nations looking to sidestep economic restrictions. If Trump’s order leads to financial strain on South Africa, it’s possible that gold—and Krugerrands in particular—could become a strategic economic tool.

What This Means for Investors

For gold investors, the situation presents both risk and opportunity. If Krugerrands become more difficult to acquire internationally, their value could increase due to scarcity. On the other hand, any restrictions on South African gold exports could create temporary market fluctuations.

The Krugerrand has stood the test of time, surviving political turmoil and economic shifts. If history has taught us anything, it’s that gold remains the ultimate store of value—no matter the policies or politics at play.

— Rael Demby, CEO of The Scoin Shop

Those looking to secure their wealth in gold may consider acquiring Krugerrands now, while they remain readily available. As history has shown, political decisions can have lasting economic consequences, and gold remains one of the few assets that can weather such storms.

Final Thoughts

While it’s too early to say whether Krugerrands will face another ban, Trump’s executive order has reignited discussions about economic pressure on South Africa. The Krugerrand has survived political turbulence before, and its legacy as a resilient gold asset continues.

For those who understand gold’s true value, owning Krugerrands isn’t just about investment—it’s about holding a piece of history.

Secure your gold today. Buy Gold & Silver Krugerrands at The Scoin Shop—online and in-store.