Share

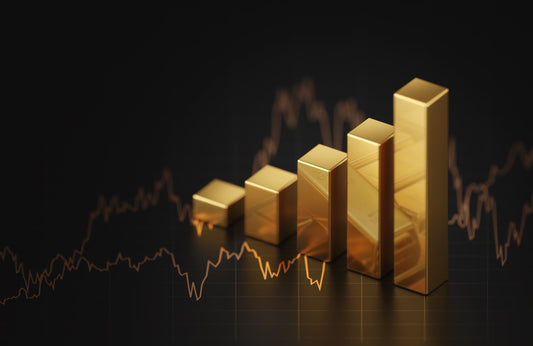

In 2025, gold prices have skyrocketed by 40% since January, reaching an unprecedented $3,600 per troy ounce. This remarkable surge, driven by global economic and geopolitical turmoil, has cemented gold’s role as a premier safe-haven asset.

Why Gold Is Shining Bright

Several key factors are behind this meteoric rise:

- Central Bank Buying Spree: Emerging market central banks have been aggressively stockpiling gold, purchasing over 1,000 tonnes annually since 2022, according to industry reports. This consistent demand provides a strong foundation for gold’s value.

- Geopolitical and Economic Instability: Rising global tensions and uncertainty surrounding U.S. tariff policies under President Trump have eroded confidence in traditional safe-haven assets like the U.S. dollar. Investors are turning to gold as a reliable hedge.

What’s Next for Gold?

Financial experts are optimistic about gold’s trajectory. Goldman Sachs forecasts prices could hit $3,700 by the end of 2025, with potential to climb to $4,500 if trade tensions worsen or the U.S. Federal Reserve’s independence faces challenges. Expected interest rate cuts in 2025 further bolster gold’s appeal as a stable, non-yielding asset.

“Gold remains a trusted choice for investors navigating these uncertain times,” Demby noted. “Its value as a safe-haven asset continues to shine through.”

Gold’s Enduring Appeal

As global markets brace for ongoing volatility, gold’s record-breaking performance underscores its timeless role as a financial refuge. Whether you’re an investor seeking stability or simply watching the markets, gold’s upward trajectory is a trend to watch closely.

Listen to the 702. interview with Rael here.